The Political Failings of ESG: Why 2024 is the Year for Policy Reform

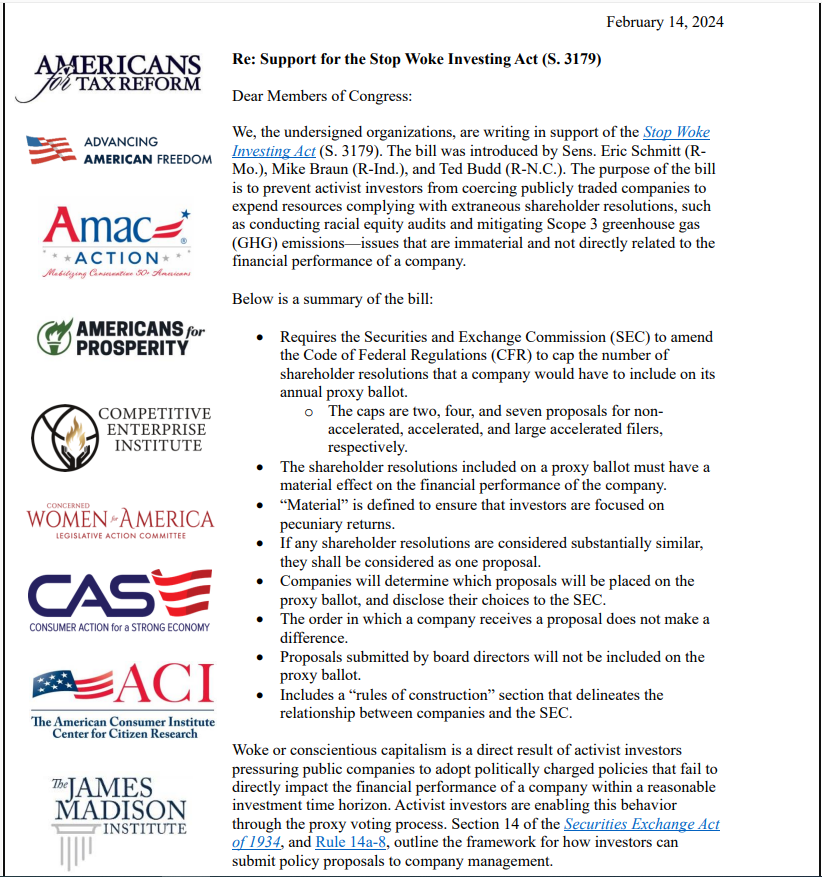

“Woke or conscientious capitalism is a direct result of activist investors pressuring public companies to adopt politically charged policies that fail to directly impact the financial performance of a company within a reasonable investment time horizon.”

~ Excerpt from a coalition letter supporting the “Stop Woke Investing Act.”

“ESG is the greatest attack on capitalism, it’s the manifestation of stakeholder capitalism that is in the ecosystem today.”

~ Rep. Andrew Barr (R-KY)

Introduction: 2024 will be a critical year for ESG reform

In this critical election year, the political fight over hot button issues is ramping up across every level of government. One of these battles is being waged over environmental, social, and governance (ESG) practices, with a growing level of corporate, policy, and legal pushback against woke investing. Republicans in Congress have a critical opportunity to strike while the iron is hot against ESG orthodoxy while it is on the retreat in corporate circles. There are a host of well-crafted anti-ESG legislative proposals in the House that are worth considering. With support for ESG on the decline in addition to state-level policy and legal pushback against ESG on the rise, now is the time for national legislation that safeguards American investors and retirees. This article will explore these efforts being pursued by conservatives in the House and the broader institutional retraction from ESG.

Last year contributed to a difficult time for ESG investing in America. Following the largest investment outflows from ESG funds in 2022, 2023 saw a retaliatory political assault launched against ESG policymaking. Red state lawmakers accelerated their attacks against federally imposed ESG policies, passing legislation that was aimed at keeping nonfinancial considerations outside of portfolio management. Certain red states like Florida led multi-state coalition to oppose the Biden Administration’s whole of government approach to regulating ESG matters across multiple executive branch and independent agencies. Florida was also instrumental in passing a number of laws that purged ESG practices from the state’s pension fund management, ensuring that retirement savings were protected from misspending on extraneous social or environmental justice agendas.

Beyond policymaking, other red states have taken the charge to overturn ESG practices in the courts. New Hampshire’s state attorney general sued the Biden Labor Department for its highly disputed ESG rule. Additionally, 26 attorneys’ generals have assembled a coalition of disgruntled trade associations, private individuals, and oil/gas companies in a lawsuit against the Labor Department’s ESG rule upending ERISA standards. While this case, Utah v. Walsh, saw the Northern District Court of Texas uphold the rule in September 2023, there is the possibility for appeal, in addition to other ongoing court challenges to the Biden Administration’s policies that enable pension fund managers to usurp fiduciary duties. One of these is Braun v. Walsh, currently pending in the Eastern District court of Wisconsin, seeking to halt the DOL ESG rule on similar grounds.

This year has already seen new dimensions emerge in the fight against ESG orthodoxy as a Trojan horse of Socialism that will kill American Capitalism. Just recently, Exxon became the first major oil producer to file a lawsuit against a federal provision that forces corporate boards to consider radical ESG shareholder proposals. Exxon’s lawsuit pressured a climate change activist group to withdraw their proposal after complaining about how the Securities and Exchange Commission (SEC) Staff Legal Bulletin 14L (SLB) has opened the floodgate for shareholder activism in the form of increased ESG proxy proposals. Despite the withdrawal of the ESG proposal, Exxon continues to press its complaint in court by targeting the larger problem of the SLB rule. This policy permits duplicative, irrelevant, immaterial, and potentially illegal ESG proposals to be considered for inclusion during the proxy review season, while neutralizing a company’s ability to invoke a “no action” request.

Congress should act swiftly against government-imposed ESG

Members of Congress, particularly in the House of Representatives, are well poised to exploit the political corrosion of ESG. 2024 presents a uniquely opportune moment for regulatory reform of ESG policy, after sustainable investing reached an inflection point in 2021 and 2022. This was followed by the first legal challenges to corporate ESG practices in 2023. The most robust federal ESG rule to date from the DOL has so far remained unharmed in the courts. This may change, given the multiple pending litigatory challenges against the rule. The opposition against ESG remains at the highest among select red states, while in the US Senate, opponents of the DOL rule convinced several Democrat Senators to overturn the measure by passing a Congressional Review Act resolution. Despite the bold bipartisan effort, the move was undermined by President Biden’s first veto.

House GOP have since proposed a number of anti-ESG measures that are worthy of greater bipartisan consideration given their safeguard of fiduciary standards, investor choice, and the prospect of higher capital gains from investments compared to ESG. There are presently around 24 anti-ESG proposals pending review in Congress, originating mostly from the House. Perhaps the most prominent of these proposals is the “Stop Woke Investing Act”, introduced by Senators Mike Braun (R-IN), Eric Schmitt (R-Mo.), and Ted Budd (R-NC), which seeks to have the SEC amend its rule 14 a-8 that grants power to the disputed SLB 14L to protect ESG shareholder proposals from corporate dismissal. The bill seeks to reestablish corporate considerations for resolutions to attach to a proxy ballot, promoting a focus on material concerns rather than immaterial ESG initiatives.

“Woke or conscientious capitalism is a direct result of activist investors pressuring public companies to adopt politically charged policies that fail to directly impact the financial performance of a company within a reasonable investment time horizon”, according to a coalition letter signed in favor of the bill. Representing the Competitive Enterprise Institute, I was among 13 individuals who pledged support.

Coalition letter in support of the “Stop Woke Investing Act”

Coalition letter in support of the “Stop Woke Investing Act”

The bill advances six proxy review reforms for amending the SEC’s 14 a-8 rule for companies. The first measure limits the number of shareholder proposals that companies will be required to include onto their proxy ballot. This will substantially lower the number of frivolous or materially irrelevant ESG proposals that crowd out the more meaningful considerations by shareholders.

Another measure in the bill requires that the company shall determine which proposals are worthy of inclusion, rather than be forced to rubber-stamp duplicative, controversial, or politically incriminating ESG matters. Such affirmed proposals would ultimately be disclosed to the SEC’s Division of Corporation Finance. Lastly, the bill does not force companies to consider or accept any particular shareholder proposal, reflecting the opposite of what SBL 14L requires. It also does not hamstring the SEC’s ability to repeal any existing rule that forces corporations to include shareholder proposals. The bill, in essence, curtails the growing rate of shareholder activism, as companies are faced with a counterproductive increase of ESG proposals that fewer and fewer shareholders are supporting. It will ensure that companies reclaim ownership and review authority over their shareholder directives.

Political Consequence and Institutional Withdrawal of ESG

Outside of the directed legal challenges and policy reform measures against ESG practices, market actors have voluntarily abandoned ESG groups. Many of these include some of the world’s largest, most elite asset managers. In fact, just last week, the wealthiest asset manager, BlackRock scaled back its participation in Climate Action 100+. This was followed by two other top asset managers, State Street and JP Morgan, deciding to drop out of the group completely. Climate Action 100+ is a radical climate change reduction alliance of renowned financial institutions around the world. It is devoted to pressuring the largest corporations to cap greenhouse gas emissions, transition to cleaner alternatives, and occasionally encourages the boycott of fossil fuel investments.

With the political pressure turning up against ESG in the U.S., Climate Action 100+ has lost the last two members who were part of the big five asset managers. This will inflict major damage to the credibility of Climate Action 100+ and hopefully will draw widespread departures from similar net-zero alliances. We may see a triggered exodus from other globalist initiatives like this as the ESG brand becomes more of a disputed term among financial leaders.

The ongoing institutional break from ESG follows after Vanguard exited the Net Zero Asset Managers (NZAM) Initiative in December 2022. Its CEO Tim Buckley discredited the group for failing to acknowledge how improbable it is for a major corporation to generate profits and pursue net-zero emissions. This, when NZAM targets and discourages the pursuit of profitable energy-related practices in the process. When exploiting the self-destructive tendencies of ESG, Buckley pointed out how since 2017, no U.S. equity managers have relied exclusively on a net-zero-carbon investment approach. Doing so undermines the passive investment philosophy that many top asset managers, like Vanguard, have successfully utilized to consistently generate long-term returns for retail investors.

Businesses typically pay close attention to signals and verbal cues given by financial elites like Larry Fink, CEO of BlackRock, who has in recent months excommunicated the term “ESG” as a politically nuclear topic. Calling the term “weaponized”, we have seen Fink retract his once exuberant embrace for ESG, despite being among the leading proponents of it since his infamous 2020 letter to CEOs that endorsed corporate transparency on climate-related practices and stakeholder-driven capitalism. In the letter, Fink once proudly said, “a company cannot achieve long-term profits without embracing purpose and considering the needs of a broad range of stakeholders.” This represents the exact opposite stance expressed by Buckley and other CEOs who doubt the financial viability ESG investing.

Now, Fink, a doctrinaire Democrat, has dialed back BlackRock’s participation in Climate Action 100+, reducing its membership to one of its lesser-known subsidiaries rather than the parent firm. This evidences the political pushback against ESG, which has produced substantial effects against the globalist alliances devoted to institutionalizing stakeholder capitalism. We will likely see further ESG withdrawal as the heat is turned up in Congress against institutional schemes that enshrine ESG, such as asset firms blacklisting corporate investments in fossil fuel.

Conclusion

My work has illustrated how ESG is on the downturn in America, facing a multi-prong assault in the courts, in Congress, and among elite asset managers. As explored by previous works, including by my father Professor Ellis Washington, the ESG phenomenon of today is anything but new, but is the Green New Deal 2.0. The environmental aspect of modern ESG investing is in many ways a repackaging of many radical, far-left political causes, like the Green New Deal, state-based carbon offsetting programs, and Al Gore’s fearmongering over “Global Warming” in the early 2000’s. My father’s work exposes how ESG was used as a mechanism for self-enrichment for Al Gore at the expense of broader corporate profitmaking. A key excerpt reads,

Members of Congress are at the tip of the spear in both exposing the failings of ESG, while drafting legislation that protects investors from the market-based harms imposed by ESG policies. Pending bills like the Stop Woke Investing Act would greatly serve public companies by providing a much-needed safeguard against the flood of ESG shareholder proposals that distract the proxy review process. This legislation would nullify the SEC’s counter-productive efforts to encourage ESG proposals and diminish corporate efforts to file “no-action letters” to block egregiously irrelevant ESG measures that run contrary to the primary interests of the company’s board of the directors.

Beyond Congress, the courts play an important role in rendering decisions that ensure fiduciary responsibilities are being carried out by pension managers and state financial officers overseeing retirement accounts. The DOL’s destructive ESG rule upends these responsibilities by enabling state financial officers to discard their fiduciary focus in exchange for providing free reign to spend retirement savings toward environmental causes or social programming (even without the retiree’s consent). Judges are obligated to uphold ERISA standards whenever ESG policies threaten to override the responsibilities of state pension managers guarding civilian retirement accounts. Legal challenges to the DOL rule and other government-imposed ESG policies will continue to be a crucial aspect to focus on in the ongoing battle against ESG.

Lastly, ESG has suffered institutional retraction among those who formerly endorsed it. This is evidenced by Larry Fink’s refusal to even utter ESG, the precipitous decline of any mention of ESG across most quarterly corporate boardroom calls, and the declining credibility of globalist alliances devoted to net-zero. We have also seen massive outflows of investor monies from ESG funds in the U.S. and world-wide, as more and more are beginning to see no clear path for profit-making or purposeful investing. As we see major asset managers leave ESG initiatives, we observe the substantial effects that political pushback can have against ESG, as lawmakers sound the alarm and anti-ESG coalitions begin to retaliate. More and more investors may become self-aware of the failings of institutionalized ESG and seek to take their money elsewhere in rebuke to such alliances like Climate Action 100+ and NZAM. With all said and done, 2024 is gearing up to be an historic year for ESG reform in America.

Category: Socrates Corner