Roger James Hamilton: Is War Coming? The Fourth Turning and Top 5 2020 Prediction Systems – Part I

Those who cannot remember the past are condemned to repeat it.

Only the dead have seen the end of war.

~ George Santayana, Philosopher

“… [If] you have the data to make a prediction you can plan for that prediction and it becomes a self-fulfilling prophecy. In fact, every public limited company is valued by the market based on how well it can predict the future. Hit a positive prediction and your price goes up – start to miss, and your shares go down.”

~ Roger James Hamilton

Prologue to The Fourth Turning 2020

This essay is a continuation to my initial analysis earlier this year in April 2020 of the work of Futurist Historians Strauss and Howe and their 1997 paradigm-changing book, The Fourth Turning—a book incidentally that former Trump senior advisor, Steve Bannon allegedly gave to President Trump who not only loved the worldview they present, but has scrupulously enacted key predictions in his major public policy initiatives. Hamilton asks us, “If you had a crystal ball to the future, what would you do with it? The 2020 pandemic and civic disorder crises we are seeing was predicted 30 years ago, and we’re only in the first of five stages.”

Below is my video transcription of the pioneering work of futurist and policy marketing analysist to entrepreneurs all over the world, Roger James Hamilton. According to an Amazon.com review of his major book, “Roger James Hamilton is a futurist, social entrepreneur and New York Times Bestselling Author of the Millionaire Master Plan. He is the founder of Entrepreneurs Institute and the creator of the Wealth Dynamics, Talent Dynamics & Genius Test Profiling Systems, used by over 250,000 entrepreneurs” to demonstrate using predictive analysis about how history, war, and public policy affect and predict market forces and the rise and fall of nations – How? It’s always the same socio-history-market-geopolitical patterns repeating itself down through the Ages, thus History is predictive if one can read and understand the signs in society.

Synopsis of the Central Ideas of The Fourth Turning

Growth, Maturation, Entropy, and Rebirth

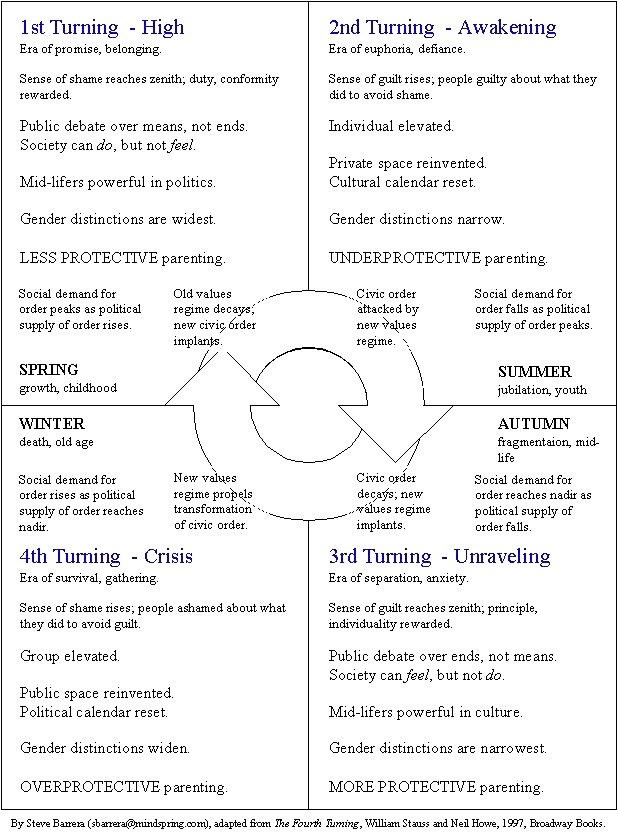

| In the book summary of William Strauss and Neil Howe’s book The Fourth Turning will change the way you see the world—and your place in it. With blazing originality, The Fourth Turning illuminates the past, explains the present, and re-imagines the future. Most remarkably, it offers an utterly persuasive prophecy about how America’s past will predict its future. Strauss and Howe base this vision on a provocative theory of American history. The authors look back five hundred years and uncover a distinct pattern: Modern history moves in cycles, each one lasting about the length of a long human life, each composed of four eras—or “turnings”—that last about twenty years and that always arrive in the same order. In The Fourth Turning, the authors illustrate these cycles using a brilliant analysis of the post-World War II period. First comes a High, a period of confident expansion as a new order takes root after the old has been swept away. Next comes an Awakening, a time of spiritual exploration and rebellion against the now-established order. Then comes an Unraveling, an increasingly troubled era in which individualism triumphs over crumbling institutions. Last comes a Crisis—the Fourth Turning—when society passes through a great and perilous gate in history. Together, the four turnings comprise history’s seasonal rhythm of growth, maturation, entropy, and rebirth. The Fourth Turning offers bold predictions about how all of us can prepare, individually and collectively, for America’s next rendezvous with destiny. |

Introduction: 00:00

[TRANSCRIPT of Roger James Hamilton] “The Fourth Turning – How does it compare to other top future predictions? – from the economic Kondratiev Waves, to the war-cycles from Arnold Toynbee and Joshua Goldstein. Are they predictions? Or plans? And is war inevitable? Hello, this is Roger Hamilton of with another episode of Entrepreneur TV and if you are trying to make sense of this crisis and figuring out what are the next steps, then this video is for you. As always, I’m going to stick to the facts and the data and at the end, I’ll give you the practical steps for you to take.

The Fourth Turning Crisis Comment Conspiracies? (Economic Update Forecasting): 00:34

Recently I uploaded a video on Ray Dalio’s prediction of a dollar crash and you can click and watch that link later, and I also uploaded a video on The Fourth Turning and the current crisis which you can be watching later as well. And in both of these videos there were plenty of comments saying this was planned and wasn’t predicted. Now before you criticize conspiracy theories, I am going to explain in this video the legitimate forecasting techniques already used by the top business leaders and government around the world. I’ll go through the business relationship about what gets predicted and what gets planned and then after watching this go ahead and make your comments.

Is it possible to predict the future? (Elon Musk vs. Warren Buffet): 01:05

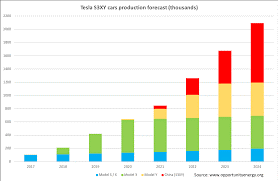

So first of all, is it even possible to predict the future. This month Elon Musk became worth even more than Warren Buffett because the market believes that he has become better at predicting the future of his business than Warren is. This graph shows a prediction of Tesla’s production from now through 2024 – Tesla’s production is in yellow and the new China factor[ies] is in red:

Now this came out after he announced his new factories and as long as his plan keeps following his predictions then he is going to keep on getting headlines like this.

Ron Baron Tesla Investor $1 Billion Headline: 01:29

Tesla investor Ron Baron sees one trillion dollars in revenue in ten years and that won’t be the end. So yes, if you have the data to make a prediction you can plan for that prediction and it becomes a self-fulfilling prophecy. In fact, every public limited company is valued by the market based on how well it can predict the future. Hit a positive prediction and your price goes up – start to miss, and your shares go down.

The Government Fourth Turning Plans/Predictions: 01:57

As for governments the stakes are much higher. The book, The Fourth Turning says we’re going into this crisis where war is inevitable so the question is if governments believe this would they plan for it? Like it or not predictions and plans [Public Policy] are linked and at the end of this video I’m going to show you not just how they’re linked but how you as a leader or an entrepreneur can use this [futurist policy knowledge] to be able to design your own future. But first let’s get context of The Fourth Turning by looking at the top five prediction systems of the last century.

Prediction System #1: Kondratiev Waves (K-Waves): 02:25

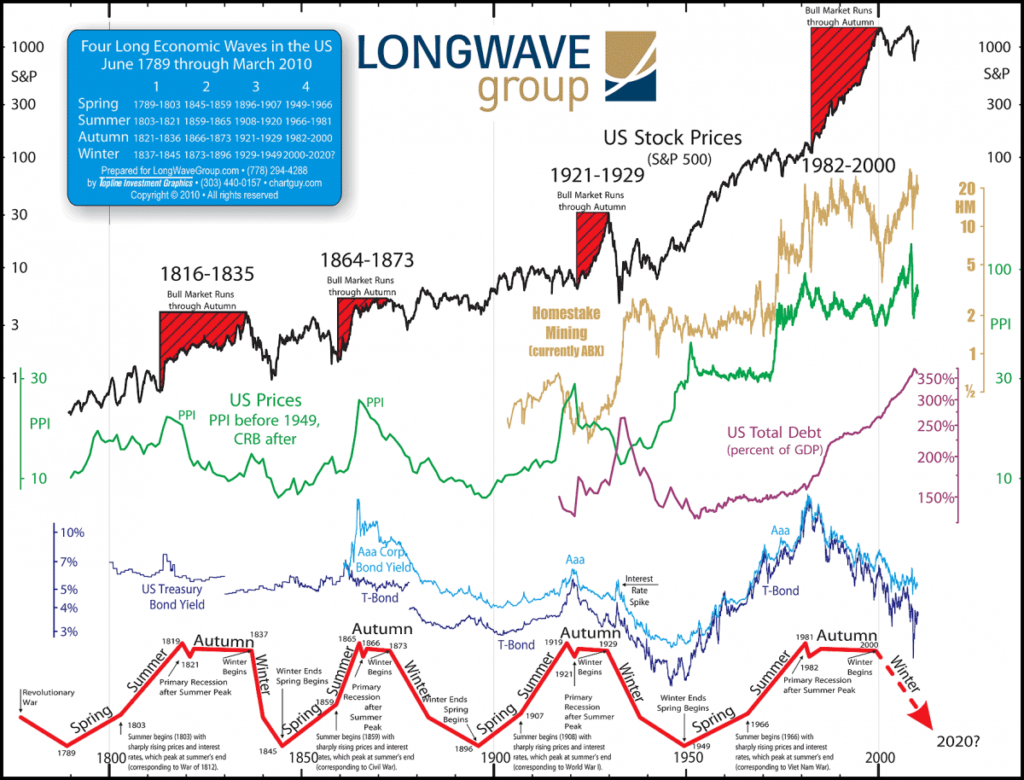

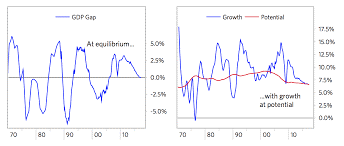

Prediction #1: K Waves or Kondratiev Waves were created by Nikolai Kondratiev who is an economist from Russia back in the 1920s. He discovered a long wave cycle in the capitalist system which links everything from innovation to interest rates to debt to trade. Here is a graph from the long wave group where it shows the last three of these waves and the fourth one that we’re in right now:

Each wave starts in the spring with a new innovation cycle with slow growth and also low debt then comes the summer where you now have high growth and high return as well has high debt. And as you get to the autumn you’re getting to a peak of both debt and return and you can see in the graph the Roaring Twenties just before the Great Depression and the big run-up on the market that we’ve seen over the last 10 years, then the winter comes when there’s a big deleveraging and a crash. You can see the last crash happened at the end of the 1920s leading to the 1930s [Great] Depression. This graph was actually drawn up in 2012 and you can see 2020 as being the next crisis point and the next depression.

Trading with Kondratiev Waves: 03:33

K Waves have been used for a long time by both commodities traders and stock market traders and of course using them turns a prediction into a plan because if people think the market’s going up they’ll buy and the market will go up – If they think it’s going down they’ll sell and it will go down.

What Happened to Nikolai Kondratieff?: 03:44

So, what happened to Kondratiev? Stalin was not happy with his economist saying that the capitalist system would recover from the [Great] Depression and so in 1938 he was not only imprisoned but he was sentenced to death and executed. The West recovered as Kondratiev predicted, but unfortunately, he was not around to see it.

Prediction System #2: Economic Waves (Kuznets Cycle, Juglar Cycles, Kitchin/Business Cycles – Joseph Schumpeter): 04:02

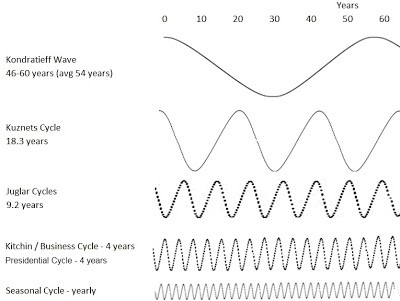

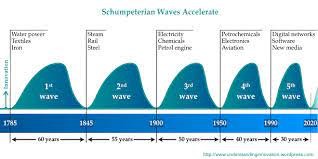

Prediction #2 is Economic Waves. Harvard professor Joseph Schumpeter took off where Kondratiev finished and combined K Waves with Kuznet Swings which are 15-25-year infrastructure investment cycles. Juglar Cycles which are more like 7 to 11-year fixed investment cycles. Kitchin Cycles which link 3 to 5-year commodity swings.

Source: http://www.liberatedstocktrader.com/stock-market-cycles-business-economic/

And he created economic long waves with this which showed boons and busts with the market. He popularized the term “Creative Destruction” showing it was entrepreneurs that were the ones who would be destructing the market over time. And you can see from this graph how this is an accelerating cycle that we’re actually living in today with the current cycle predicted also to end in 2020.

Prediction System #3: Ray Dalio’s Currency Cycles (Long Term Debt Cycle): 04:41

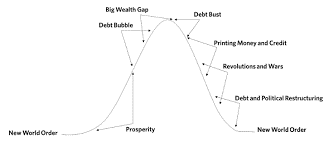

Which brings us to Ray Dalio’s Currency Cycles. In a recent LinkedIn post Ray explains how because governments are able to predict these business cycles, they counter them with their own plan cycles of printing money and issuing debt.

He says, “these moves typically come in the form of short-term debt cycles and long-term debt cycles. The short-term cycles of ups and downs typically last about 8 years give or take a few. He goes on to say most people have seen enough of these short-term debt cycles to know what they are like so much that they mistakenly think that they will go on working this way forever.

Over long periods of time these short-term debt cycles add up to long-term debt cycles that typically last about 50 to 75 years.

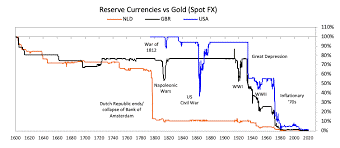

Because they come along about once in a lifetime most people aren’t aware of them, as a result they typically take people by surprise which hurts a lot of people. The last big long-term debt cycle was put in place in 1945 when World War II ended, and we began the dollar U.S. dominated world order. Here’s a graph from Ray which shows the last two global reserve currencies – the Dutch guilder and the British pound:

Ray Dalio Fox Interview on War and Fed Balance Sheet: 05:51

And it predicts the coming to an end of the current debt cycle and the end of the U.S. dollar as a reserve global currency. And here’s what Ray Dalio had to say this week in a Fox News interview. He says –

| “There is a trade war, there’s a technology war, there’s a geopolitical war, and there could be a capital war – that’s the reality. If we don’t work together to do the sound things, to be more productive, to earn more than we spend, to build the stability of our currency, and build a good balance sheet we are going to decline.” |

Of course, Ray is familiar with K Waves with economic waves, with business cycles. He spent his life looking at these patterns.

Bridgewater Associates Hedge fund Predictions: 06:19

And if you need proof to show that predictions can turn into plans Ray has used all of these systems to be able to create trading algorithms that has turned his company which was Bridgewater Associates into the largest hedge fund in the world. It’s worth over $138 billion today simply because Ray had become better a planning at planning for these predictions than most others.

Epilogue: Synopsis of The Fourth Turning

Now let us review. Roger James Hamilton’s video titled—The Fourth Turning and the Top 5 2020 Predictive Systems. Remember, to understand these predictive systems (e.g., Theories not CIA False Flag propaganda = ‘Conspiracy Theory’) in the context that they were made – as a predicate to the next global cataclysm of our times (World War III, or IV if one counts the Cold War as World War III]). That said, Hamilton stated these 5 predictive systems:

- Prediction System #1: Kondratiev Waves (also called Supercycles, Great Surges, Long Waves, K-Waves or the Long Economic Cycle) – “In economics, Kondratiev Waves are hypothesized cycle-like phenomena in the modern world economy.[1]

- Prediction System #2: Economic Waves (Kuznets Cycle, Juglar Cycles, Kitchin/Business Cycles – Joseph Schumpeter) – Joseph Schumpeter put forward the idea that there were four economic cycles: Kitchin, Juglar, Kuznets and Kondratieff.

- “The Kuznets swing (or Kuznets cycle) is a claimed medium-range economic wave with a period of 15–25 years identified in 1930 by Simon Kuznets.[1] Kuznets connected these waves with demographic processes, in particular with immigrant inflows/outflows and the changes in construction intensity that they caused, that is why he denoted them as “demographic” or “building” cycles/swings. Kuznets swings have been also interpreted as infrastructural investment cycles.”

- “The Juglar cycle is a fixed investment cycle of 7 to 11 years identified in 1862 by Clément Juglar.[1] Within the Juglar cycle one can observe oscillations of investments into fixed capital and not just changes in the level of employment of the fixed capital (and respective changes in inventories), as is observed with respect to Kitchin cycles. 2010 research employing spectral analysis confirmed the presence of Juglar cycles in world GDP dynamics.”

- “Kitchin Cycle is a short business cycle of about 40 months discovered in the 1920s by Joseph Kitchin.[1] This cycle is believed to be accounted for by time lags in information movements affecting the decision making of commercial firms.”

- Kondratiev Cycle (See definition above under Prediction System #1)

- Prediction System #3: Ray Dalio’s Currency Cycles (Long Term Debt Cycle) – For paper currency (and its historical internecine battles with gold existing for over 3,000 years), there is always a boom-bust cycle. It often begins with the healing of a country’s economic woes and promises of prosperity for all:

- “Stage 1 is fueled by optimism and euphoria as politicians promise growth stimulus with the least amount of pain and discipline.

- Stage 2, restrictions would be slowly removed from the currency-creation process.

- Stage 3 is the gambling stage where excessive liquidity makes its way into the stock market and real estate market. Growth will start to slow down and therefore, more money needs to be created to stimulate growth.

- Stage 4 is the penultimate stage of the fiat cycle. Sluggish growth in western countries force financial institutes to try make money through other means than financing and brokerage fees.

- Stage 5 occurs when there is hyperinflation, which is the worst economic phase of the fiat cycle. In stage 5, the currency becomes worthless.”

- Prediction System #4: Generations (Neil Strauss and William Howe) – Describes a theorized recurring generation cycle in American history and global history. It was devised by William Strauss and Neil Howe.

- “According to the theory, historical events are associated with recurring generational personas (archetypes).

- Each generational persona unleashes a new era (called a turning) lasting around 20–22 years, in which a new social, political, and economic climate exists. They are part of a larger cyclical “saeculum” (a long human life, which usually spans between 80 and 90 years, although some saecula have lasted longer).

- The theory states that after every saeculum, a crisis recurs in American history, which is followed by a recovery (high).

- During this recovery, institutions and communitarian values are strong. Ultimately, succeeding generational archetypes attack and weaken institutions in the name of autonomy and individualism, which ultimately creates a tumultuous political environment that ripens conditions for another crisis.”

- The theory states that after every saeculum, a crisis recurs in American history, which is followed by a recovery (high).

- Prediction System #5: War Cycles (Quincy Wright, A Study of War, Arnold Toynbee) – “During the 1920s, the horrors of World War I were foremost in the thoughts of many social scientists. Soon after his arrival at Chicago, Wright organized an ongoing interdisciplinary study of wars, which eventually resulted in over 40 dissertations and 10 books. Wright summarized this research in his magnum opus A Study of War (1942).”

To keep this analysis of Hamilton’s work in a digestible format, I have divided the video transcript into two parts. In Part I, I have covered Prediction Systems #1-3, with Part II covering Predictive Systems #4-5 and Hamilton’s conclusory remarks that will help U.S. avoid the negative aspects of predictive systems while embracing the positive, life-affirming parts. Part II of this essay series should be published early next week.

End of Part I

Category: Uncategorized